As for the wealthy, forced to pay more, they would emigrate from Illinois, they said, leaving the middle class to pay a greater share. Opponents contended that Pritzker and fellow Democrats who control the General Assembly would not use the extra revenue to pay debts but instead for new and expanded programs.

Those with incomes over $250,000 would pay higher incremental rates, topping out at 7.99%.ĭubbed the “fair tax” by Pritzker and supporters, it was to generate an extra $3 billion a year to help pay down an $8.3 billion backlog in past-due bills, fill revenue gaps in the state budget that lawmakers had hoped federal pandemic relief would fill, and billions of dollars more in debt.īoth sides of the debate invested heavily in their positions, spending a combined $100 million on advertising. He contended that anyone making less than $250,000 - 97% of taxpayers - would pay the current rate or less. Pritzker campaigned to amend the 1970 charter to allow a progressive rate.

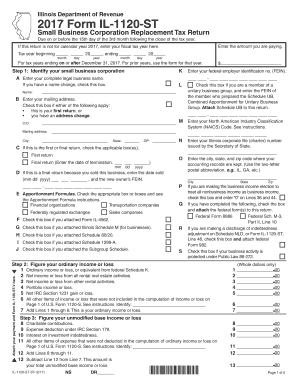

The Illinois Constitution requires that all income be taxed at a flat rate - currently 4.95%.

0 kommentar(er)

0 kommentar(er)